Next story: GSA is Second Federal Agency to Consider Moving Truck Traffic Off the Peace Bridge

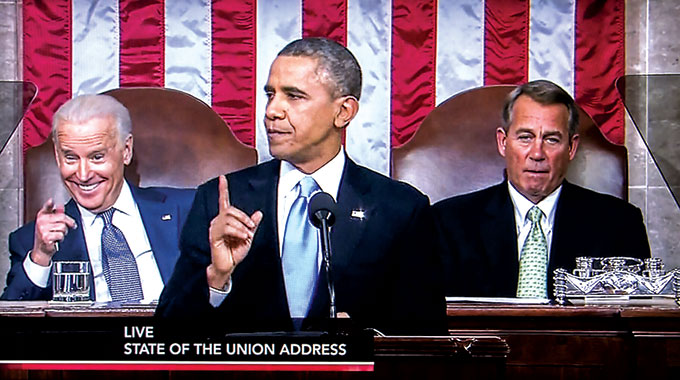

Professor Obama's Amnesia

by Bruce Fisher

The “Crisis!” film series our president should host

Progressives got themselves quite excited recently. There was widespread speculation that President Obama’s fifth State of the Union address would squarely address the radically amplified trend toward income inequality that has begun to become a political fact since Bill DiBlasio’s landslide victory in New York City’s mayoral race. DiBlasio squarely addressed the facts about the 99 percent that then-Senator Barack Obama had no trouble articulating in the 2008 campaign, and that his opponent Mitt Romney ill-advisedly scoffed at in the 2012 campaign. The electorate may be experiencing great confusion about why it’s so, but there is increasing clarity about the near-universal experience of American working people working the same or harder for the same or less.

What progressives had been hoping for is further clarity from Obama about why it’s so. Robert Reich’s new movie Inequality for All does a good job, which is why we’ve included it in the free “Crisis!” film series that starts Thursday, January 30 at the Burchfield Penney Art Center. Emmanuel Saez and Robert Piketty do a great job of explainiing how 93 cents of every new dollar in the post-2008 economy has gone to the top one percent. But at some point—say, at the beginning of the year in which the entire House of Representatives is up for re-election—one might reasonably expect that the explainer-in-chief, the top educator in the land, the law professor become the law-giver, would take the lead in describing the perils of letting the trend remain undisturbed, and the steps we need to take to change course.

The first hint that Obama was not going to go down that road came in his explanation of what happened in the year he campaigned for and won his office. He didn’t describe the pop of the housing bubble, or the bankruptcy of Lehman Brothers, or the trillion-dollar-plus taxpayer-funded bailout of the banks in 2008 and 2009 as a financial calamity, a regulatory failure, a criminal conspiracy gone wrong, or a disaster that exposed the rottenness of our globalized, financialized, anti-worker Ponzi scheme of insider-dealing gangster-politician-bankers. Nope. Not a word of it. Obama described 2008 and its aftermath as “the great recession.”

If you want to know why, read Reckless Engangerment, the book by New York Times reporter Gretchen Morgenson and investment analyst Joshua Rosner.

Many hands on the knife

Morgenson and Rosner carefully explain the history of the mortgage crisis that enveloped the United States and then disrupted the entire world economy. The story is centered on the bank-like, taxpayer-supported outfits known as Fannie Mae and Freddie Mac, which were created to help Americans borrow money to buy their own homes. Whether the rhetoric was Republican George W. Bush’s call to make America an “ownership society” or Democratic Congressman Barney Frank’s relentless advocacy for low-income households getting a chance at “the American Dream,” the result was the same: Republicans and Democrats invested politically, legislatively, and as regulators in wrecking what had been a very well functioning system that made mortgages available to millions of working- and middle-class homeowners, but that required of them that they have some measure of creditworthiness before they got the help. Until the mid-1990s, one used to have to demonstrate something like adult behavior in terms of showing up for work, paying one’s bills on time, saving a few bucks, and generally being a reasonable risk before one could qualify for a mortgage. That changed. Ideologues of both parties changed it. Political operatives of both parties made sure that it changed. Intellectuals and scholars of every political persuasion got fees, subsidies, grants, and career-advancing conferences and publications for standing up and saluting the change.

And bankers, mainly on Wall Street but everywhere else around the country, got in on the deal. There was big money to be made by letting poor people take out mortgages they couldn’t handle, especially when the properties they were being loaned money to buy were being appraised as ever-more valuable. Mortgage bankers made big fees handing out mortgages like Halloween candy, and mortage-bundlers made big money packaging up newly invented investment devices that could be traded on the big exchanges as if they were the equivalent of contracts for pork bellies, bushels of wheat, or barrels of oil—as if these mortgages were real things, like actual commodities with a market value, rather than promises that could not be kept.

Barack Obama was not free to say a negative word about what caused what he called “the great recession” because everybody who created the disaster is still in power. But don’t for a moment imagine that this is a Democratic dilemma. Neither George W. Bush nor Barack H. Obama, nor the Republican leadership of the House of Representatives nor the Democratic leadership of the US Senate, is at liberty to blame any Republican or any Democrat for having enabled, empowered, and profited from as well as having politically benefitted from the disaster they all had a hand in engineering.

Because they all had a hand in it, and they haven’t changed the law in any significant manner to prevent it from happening again.

Viewing the crisis from Buffalo

Here in Buffalo, where every single one of our public-funded construction projects and every cent of the Buffalo Billion depends on the tax revenue from New York City, we have an opportunity to see with some clarity—because without the ongoing profitability of Wall Street, we would’t have the construction cranes, the medical corridor, or the other inputs that are lifting hopes and spirits. When first George W. Bush and then Barack H. Obama authorized the transfer of hundreds of billions of dollars to stabilize the collapsing financial system in 2008 and 2009, back when the market value of all those Fannie Mae mortgages abruptly dropped, the bailout money kept us going, too.

The second-most alarming quote from the Morgenson-Rosner book is not from a politician, a banker, or from one of the few non-compromised researchers who frantically warned about the coming calamity. It’s from a long-deceased Frenchman named Frederic Bastiat. “When plunder becomes a way of life for a group…they create for themselves in the course of time a legal system that authorizes it and a moral code that glorifies it.” Yipes. That’s sort of what we have today, still.

The truly alarming message of this book, however, is the list of names of all the people who made the problem happen. The current and the last two secretaries of the treasury, the last two heads of the Federal Reserve, the leading Republicans and Democrats in law, finance, housing, and regulation…Yipes. They’re all still in power. And their party identity doesn’t seem to matter. And they cycle from the White House to the Cabinet to the banks and investment firms and think tanks and back. Round and round.

We’ll be talking about the movie versions of all this every Thursday evening at 6:30pm at the Burchfield-Penney Art Center, and then watching the movies at 7pm. Come enjoy the show in one of the lovely places at all that Wall Street money helped fund.

Bruce Fisher is director of the the Center for Economic and Policy Studies at Buffalo State College. His recent book, Borderland: Essays from the US-Canada Divide, is available at bookstores or at www.sunypress.edu.

blog comments powered by Disqus|

Issue Navigation> Issue Index > v13n5 (Week of Thursday, January 30) > Professor Obama's Amnesia This Week's Issue • Artvoice Daily • Artvoice TV • Events Calendar • Classifieds |

Current Issue

Current Issue